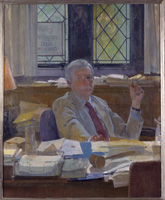

Francis William Coker, Jr. (1917-62) was a graduate of Yale College (1939) and the Law School (1946). He left a partnership at Paul, Weiss, Rifkind, Wharton & Garrison to join the faculty and, at the time of his untimely death, was also a consultant to the U.S. Securities and Exchange Commission. In that position, he developed the regulatory structure for issuers of variable annuity contracts under the Investment Company Act of 1940. He was also in charge of an inquiry reexamining the Investment Company Act, which had to be adapted to the sea change in the mutual fund industry caused by the extraordinary growth in funds’ equity holdings by the early 1960s.

Francis Coker was not a prolific publisher, in part because, as Joseph Bishop put it, he was a “perfectionist.” But Coker’s intellect was greatly admired by his colleagues. As Bayless Manning explained in tribute: “Consultation with Frank did not primarily produce extra information, or suggestions for research. It added new comprehension, new scales of proportion, new perceptions of relevancy, and new questions more interesting than the one with which one began.” Similarly, Bishop stated: “I have known a good many first-rate lawyers, some first-rate teachers, and a few first-rate men, but none who impressed me more powerfully than Frank … He never stopped chewing and worrying at a problem until he had it licked, and he never accepted an easy or superficial solution… . Frank was a skeptic without being a cynic. He never accepted an idea, no matter how respectable its antecedents and references, without examining it for himself… . You could try any idea in the world on Frank and never encounter a prejudice, though very few ideas emerged intact from that mill, for it ground exceedingly small.”

Coker was a dedicated and beloved teacher, as the tribute to him by the editors of the Yale Law Journal in 1962-63 conveys: “[A]nyone who sat at Professor Coker’s feet for a semester could not but feel himself the recipient of a unique blend of perception, skill, dedication, and delight… . Such was the intellectual honesty, analytical prowess, and ethical dedication which Professor Coker bestowed on his students. With all the gift of pedagogy that Professor Coker possessed went a warmth, a spirited cheeriness, a tolerance, and an unsparing generosity of self that made students flock to him and gave his teaching the peculiar imprint of his person.”

A fund that supports the first year small group teaching assistants was established in his honor at the Law School in 1963.

REFERENCES

Joseph W. Bishop, Jr., “Francis W. Coker, Jr.,” 72 Yale L. J. 1 (1962).

William L. Cary, “Francis W. Coker, Jr., and the Securities and Exchange Commission,” 72 Yale L. J. 4 (1962).

Bayless Manning, “The Shareholder’s Appraisal Remedy: An Essay for Frank Coker,” 72 Yale L. J. 223 (1962).

“Tribute to Professor Coker,” 72 Yale L. J. 6 (1962).